Like many things here, consumption tax in Japan is different from consumption tax elsewhere in some quite fundamental respects. Firstly, the rate is a low 5% and has been so for many years. This means that accounting for consumption tax correctly and promptly is not as critical as it is in most other countries.

Secondly, consumption tax is calculated and reported at the end of the financial year in the same way that corporation tax is calculated. You simply take 5% of taxable income or outputs excluding tax and deduct 5% of taxable expenses or inputs excluding tax. This is quite unlike Australia where tax has to be considered on every single transaction and returns must be submitted quarterly. This also means that in Japan, businesses can leave the calculation of consumption tax for the tax agent to do at the end of the year.

Thirdly, small businesses pay no consumption tax for the first two years of trading and only pay in the third year if turnover in the first year is over ¥10,000,000. In Australia, there is no such grace period.

However, after many years of debate, the government seems likely to increase the rate to 8 percent in April 2014, and then to 10 percent in October 2015. Thus, consumption tax will become a more significant tax on businesses and will have to be accounted for more thoroughly.

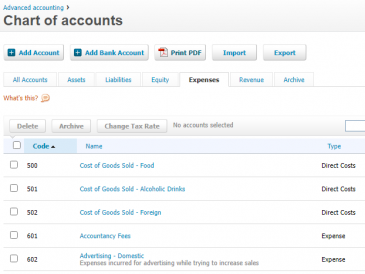

Accounting programs such as MYOB can easily be set up to account for consumption tax automatically so that provision is made for the tax continually and there are no surprises at the end of the year.