There are often several ways of doing the same thing in accountancy and that goes for using Xero too. Sometimes these different ways can be equally good but at other times the best method might depend on your personal preference or the way your business works or who will be using the file or the reports. However, there are some general Xero rules that apply to all businesses all the time; here are my top ten tips.

- Lock the file up to the date of the last tax return in order to prevent accidental changes to data in prior years. Your Xero file holds all data since the file was created, which is great for getting immediate access to previous transactions and comparing the profit and loss with many previous years but if the file is not locked, those old transactions can very easily be changed accidentally or intentionally, which could make the current year’s figures wrong. It could be a tricky and time consuming job to locate the changes and correct them. The only way to safeguard against accidentally changing the previous year’s figures is to lock the file in Financial Settings.

- Do not create a real bank or cash account as an ordinary “current asset” type of account. Set them up as “Bank” type accounts as “Bank” type accounts have many extra useful features. In fact, it’s often a good idea to setup non-bank and cash accounts, such as loan accounts, as “Bank” type accounts.

- Enter sales as sales invoices in the sales module and bills as bills in the purchases module rather than as manual journals as the sales and purchases modules have many useful features.

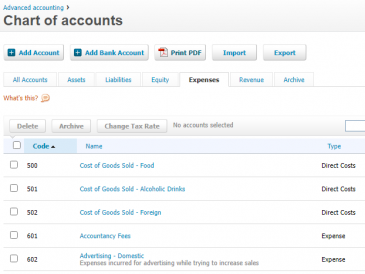

- Use no more than three or four numbers for each account code. That will give you at least 999 different account numbers to choose from. It’s often quicker and easier to remember an account code rather than an account name which might be similar to another account name. Furthermore, account groups on the financial statements are created by formatting the financial statements and are not linked to account numbers.

- Delete users who no longer need access to the file to reduce the risk of ex-users logging in.

- Ensure the correct default tax code is used for all accounts. This will speed up data entry. The default tax code can easily be over-ridden if necessary.

- Name the Xero file the actual name of the business entity so that it is clear to all that the Xero file is the actual accounting system for the business. The one file continues year after year and holds all transactions for each year so the file name should not change and be applicable year after year.

- Give meaningful names to each account. For example, create a loan account for each lender (“Loan Payable – John Smith”) rather than have one combined loan account. Create a separate rent expense account for each rented property rather than have one rent account. This will make it much easier to keep track of each lender or rented property. Tax accountants usually combine these accounts in the financial statements and have details in notes to the accounts but there are no notes to the accounts in Xero so the chart of accounts must be sufficiently detailed. On the other hand, don’t create new accounts unless they will be useful as too many accounts slow down data entry.

- Archive accounts that are no longer being used to speed up data entry. Also consider archiving accounts that have a balance but will never be or will rarely be changed, such as Share Capital. This effectively locks them so they cannot be accidentally changed. Archived accounts can easily be restored if necessary.

- Don’t create a tracking category unless you run reports on the category and use the information. If you use tracking, then you have an extra field to think about when entering every transaction so there’s no point in creating the tracking category unless it’s going to be useful.