Xero does have various country-specific versions but not a Japanese version, only a global version, so you may wonder if the global version is suitable for Japan. The short answer is Yes but there are some provisos: If you are already using Xero for other related companies, then it makes perfect sense to also use …

Xero Best Practice Top 10 Tips

There are often several ways of doing the same thing in accountancy and that goes for using Xero too. Sometimes these different ways can be equally good but at other times the best method might depend on your personal preference or the way your business works or who will be using the file or the reports. …

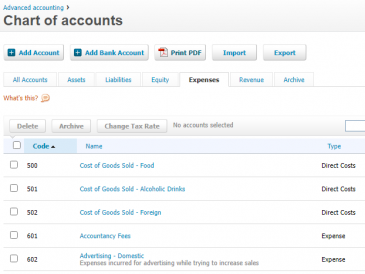

Numbering the Chart of Accounts

You might wonder what is the rationale for the numbers in the chart of accounts? Certainly, in a manual system for a small business, there is no need to number the chart of accounts so the numbers were introduced when small business accounting went computerised.

The Fascination of Accountancy

Do you find accountancy fascinating? Some of my clients love it. I’ve met engineers, stock brokers, shop keepers, hoteliers and others who want to do as much of the work as possible themselves though they’ve never had any accountancy training. I enjoy training my clients and am happy to tell them as much as …

Payroll in Japan

Payroll in Japan can get quite complicated with basic wages, overtime and bonuses less deductions for income tax, residents tax, health insurance, over 40 health insurance, pension and labour insurance, not forgetting the employer’s contribution to employees’ health insurance, pension and labour insurance. Then of course you not only do you have to pay employees …

Finding a Japanese Tax Agent

Most businesses need to engage a tax accountant to help them prepare and lodge a tax return at the end of each financial year. I also recommend that businesses with employees should generally get a Japanese tax accountant to prepare the employee payroll, or at least have a Japanese tax accountant on call for questions …

WorkflowMax project management software

WorkflowMax is an integrated, online all-in-one project management software program. It handles the whole process from lead to quotes, job management, time-recording, purchase orders, invoicing and reporting all in the cloud. It’s a Xero product and so integrates well with Xero accounting software. Find out more at www.workflowmax.com or ask me for a demonstration.

The KISS Principle – Keep it simple, stupid

Business owners like to get into some overly complicated or even dodgy deals from time to time, which may be OK if you’re on your own but may not, in my opinion, be such a good idea if you employ staff. “Tone at the top” is what auditors call it: owners should be leading by example …

MYOB or Xero?

A few years ago I took a quick look at Xero and felt its accounting features were not strong enough to justify changing from MYOB. It was totally online but I didn’t consider the benefits of an online accounting program at all. In October 2012, MYOB released its online version and I was keen to …

DD/MM/YY, MM/DD/YY, YY/MM/DD or HH/MM/DD

It amazes me that in this age where just about every piece of information on earth has been digitized on to computers that we have not standardized the date, which is absolutely critical to any accounting system, if not life in general. The British and the Australians say DD/MM/YY, the Yanks and Canadians say MM/DD/YY, …